Platforms

Accelerating digital

financial services for smallholder farmers in Africa

Smallholder Farmer

Context

in Africa

Depend on small or micro-scale farming as their primary source of livelihood.

The agricultural sector in Africa accounts for 20 - 40% of the continents GDP.

According to the World Bank, meeting Africa’s demand for food requires $80 billion annually.

It is projected to be a $1 trillion industry by 2030 but receives less than 3% of banking credit.

Challenge

Agricultural Development

The challenges of agricultural development are multiple and complex. High systemic risks: from the

environment (drought, flood and disease) and from markets (price volatility, trade policy and

trade practices affecting exports and market access) are critical challenges.

Financing is

a major barrier to growth in Africa’s agricultural sector, particularly for smallholder farms.

Interest rate are particularly high, up to 47%. The lack of collaterals from farmers and

businesses, combined with difficulties for banks to price the risk of loans to smallholder farmers

is an important impediment to the development of the sector. Other key challenges are the lack of

adequate rural infrastructure, lack of access to the range of inputs required by farmers,

knowledge gaps, including financial literacy, and the lack of reliable data.

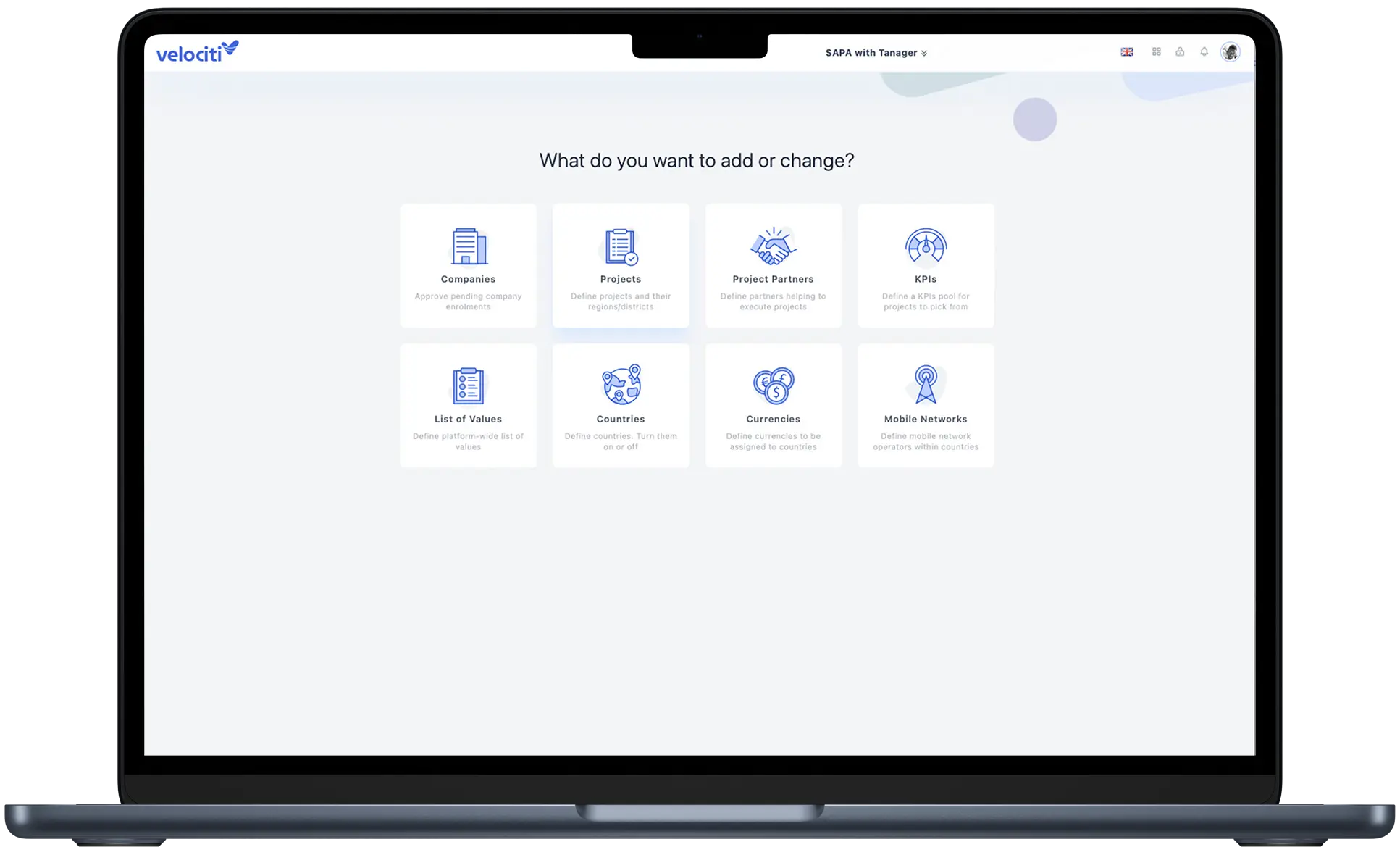

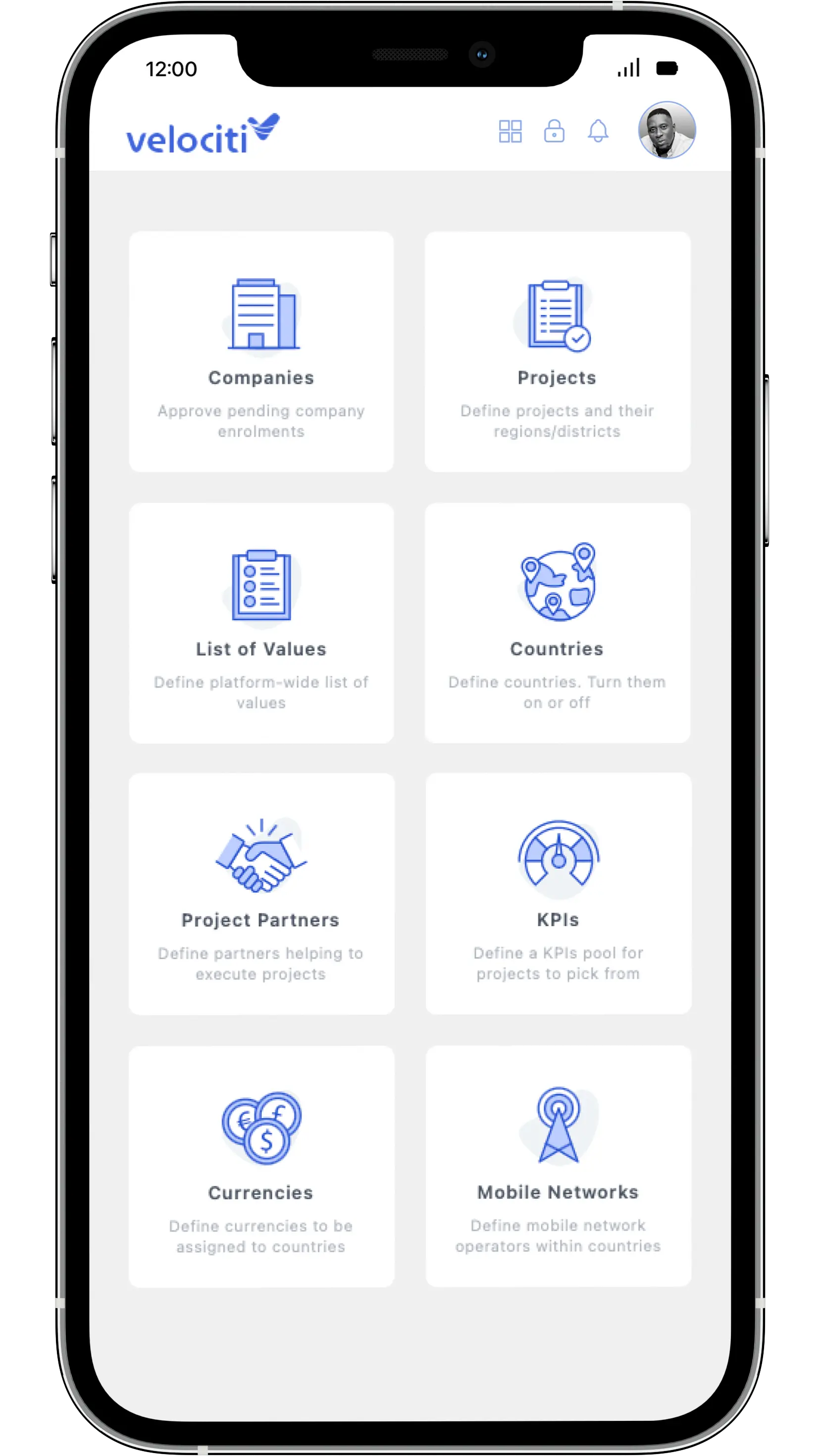

Velociti

Velociti is accelerating the access to digital financial services for the underserved in the African agricultural ecosystem by using big data, machine learning and AI to build alternative data for rural smallholder farmers to access financial services such as micro lending, mobile payments, insurance & savings and pensions. In the next 5 years, Velociti targets more than 15 million smallholder farmers in Africa.